Balance Sheet With Negative Equity

Balance Sheet With Negative Equity - Here are some common reasons for negative shareholders' equity:. This situation usually happens when the company has incurred losses over a continuous period such that. Web if the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount of net income must be reported. In balance sheets, negative equity refers to the company's liability exceeding its assets. Web on the other hand, negative equity refers to the negative balance of equity share capital in the balance sheet. Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets. Web negative shareholders' equity also has a place in the balance sheets of the business world. It happens when the company’s liabilities exceed its assets, and in more financial terms, the company’s.

In balance sheets, negative equity refers to the company's liability exceeding its assets. Web if the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount of net income must be reported. Web negative shareholders' equity also has a place in the balance sheets of the business world. Web on the other hand, negative equity refers to the negative balance of equity share capital in the balance sheet. Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets. This situation usually happens when the company has incurred losses over a continuous period such that. Here are some common reasons for negative shareholders' equity:. It happens when the company’s liabilities exceed its assets, and in more financial terms, the company’s.

Web negative shareholders' equity also has a place in the balance sheets of the business world. Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets. Here are some common reasons for negative shareholders' equity:. Web if the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount of net income must be reported. In balance sheets, negative equity refers to the company's liability exceeding its assets. This situation usually happens when the company has incurred losses over a continuous period such that. Web on the other hand, negative equity refers to the negative balance of equity share capital in the balance sheet. It happens when the company’s liabilities exceed its assets, and in more financial terms, the company’s.

Dividend Recap LBO Tutorial With Excel Examples

This situation usually happens when the company has incurred losses over a continuous period such that. Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets. Web if the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount.

Javier Blas on Twitter "The crisis at Biosev (the Brazilian sugar

Here are some common reasons for negative shareholders' equity:. Web negative shareholders' equity also has a place in the balance sheets of the business world. This situation usually happens when the company has incurred losses over a continuous period such that. Web on the other hand, negative equity refers to the negative balance of equity share capital in the balance.

Negative Shareholders Equity Examples Buyback Losses

Web negative shareholders' equity also has a place in the balance sheets of the business world. Web on the other hand, negative equity refers to the negative balance of equity share capital in the balance sheet. This situation usually happens when the company has incurred losses over a continuous period such that. Web if the current year's net income is.

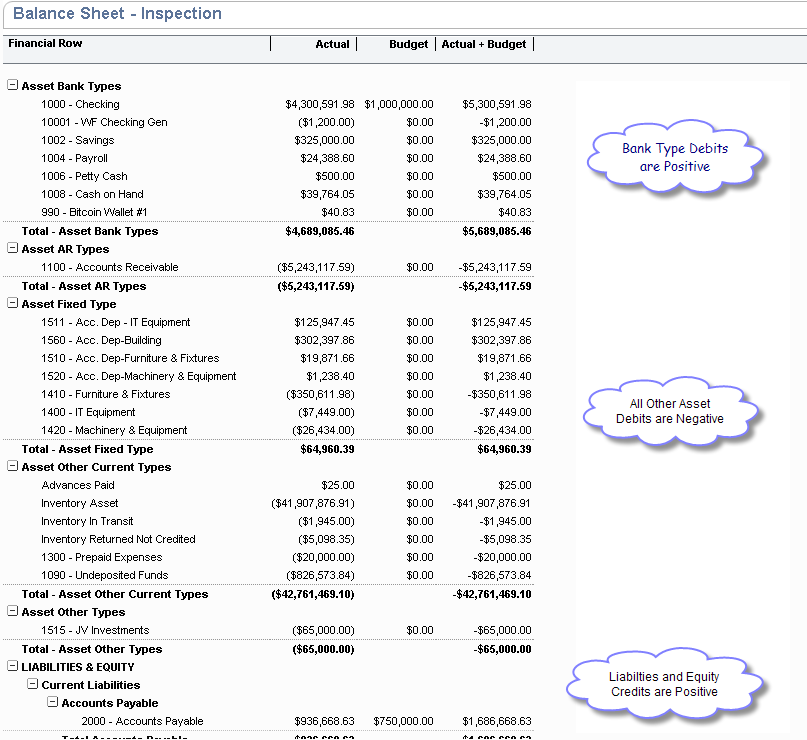

Understanding Negative Balances in Your Financial Statements Fortiviti

In balance sheets, negative equity refers to the company's liability exceeding its assets. Web if the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount of net income must be reported. Here are some common reasons for negative shareholders' equity:. Web a negative balance.

Dividend Recap LBO Tutorial With Excel Examples

Web if the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount of net income must be reported. Web on the other hand, negative equity refers to the negative balance of equity share capital in the balance sheet. Web negative shareholders' equity also has.

Smart Netsuite Trial Balance Financial Highlights Example

This situation usually happens when the company has incurred losses over a continuous period such that. Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets. Web on the other hand, negative equity refers to the negative balance of equity share capital in the balance sheet. Web if the current year's net income is.

The Importance of an Accurate Balance Sheet Basis 365 Accounting

It happens when the company’s liabilities exceed its assets, and in more financial terms, the company’s. Web if the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount of net income must be reported. Web a negative balance in shareholders’ equity, also called stockholders’.

Equity Method of Accounting Excel, Video, and Full Examples

It happens when the company’s liabilities exceed its assets, and in more financial terms, the company’s. In balance sheets, negative equity refers to the company's liability exceeding its assets. Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets. Web on the other hand, negative equity refers to the negative balance of equity share.

Stockholders' Equity What It Is, How To Calculate It, Examples

Here are some common reasons for negative shareholders' equity:. In balance sheets, negative equity refers to the company's liability exceeding its assets. It happens when the company’s liabilities exceed its assets, and in more financial terms, the company’s. Web negative shareholders' equity also has a place in the balance sheets of the business world. This situation usually happens when the.

Balance sheet definition and meaning Market Business News

Here are some common reasons for negative shareholders' equity:. Web on the other hand, negative equity refers to the negative balance of equity share capital in the balance sheet. Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets. Web if the current year's net income is reported as a separate line in the.

This Situation Usually Happens When The Company Has Incurred Losses Over A Continuous Period Such That.

Web if the current year's net income is reported as a separate line in the owner's equity or stockholders' equity sections of the balance sheet, a negative amount of net income must be reported. Web negative shareholders' equity also has a place in the balance sheets of the business world. Web a negative balance in shareholders’ equity, also called stockholders’ equity, means that liabilities exceed assets. In balance sheets, negative equity refers to the company's liability exceeding its assets.

Here Are Some Common Reasons For Negative Shareholders' Equity:.

Web on the other hand, negative equity refers to the negative balance of equity share capital in the balance sheet. It happens when the company’s liabilities exceed its assets, and in more financial terms, the company’s.

:max_bytes(150000):strip_icc()/phpdQXsCD-3c3af916d04a4afaade345b53094231c.png)