Off Balance Sheet Products

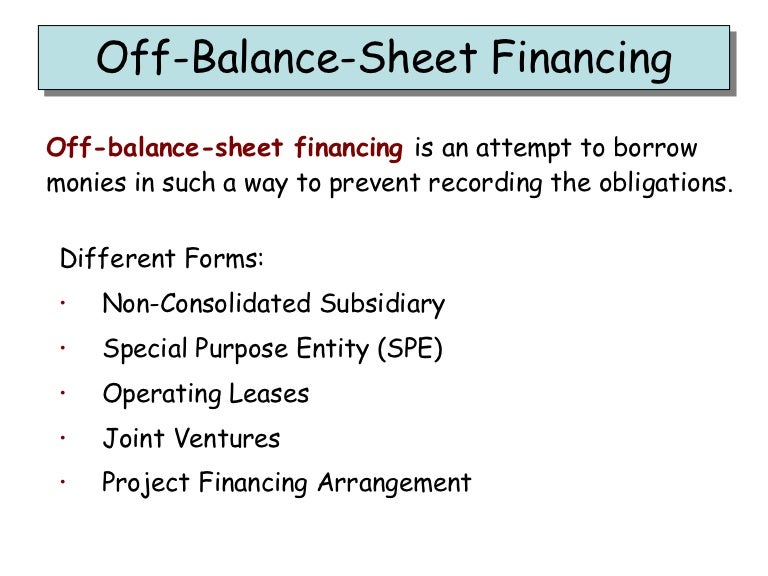

Off Balance Sheet Products - They are either a liability or an asset which are not shown on a company’s balance. These items are assets and liabilities of the company, even if they. An obs operating lease is one in which the lessor retains the leased asset on its balance sheet. Obs assets can be used to shelter financial statements from asset ownership and related debt.

These items are assets and liabilities of the company, even if they. Obs assets can be used to shelter financial statements from asset ownership and related debt. They are either a liability or an asset which are not shown on a company’s balance. An obs operating lease is one in which the lessor retains the leased asset on its balance sheet.

An obs operating lease is one in which the lessor retains the leased asset on its balance sheet. Obs assets can be used to shelter financial statements from asset ownership and related debt. They are either a liability or an asset which are not shown on a company’s balance. These items are assets and liabilities of the company, even if they.

💋 Off balance sheet items. What are off. 20221121

They are either a liability or an asset which are not shown on a company’s balance. An obs operating lease is one in which the lessor retains the leased asset on its balance sheet. These items are assets and liabilities of the company, even if they. Obs assets can be used to shelter financial statements from asset ownership and related.

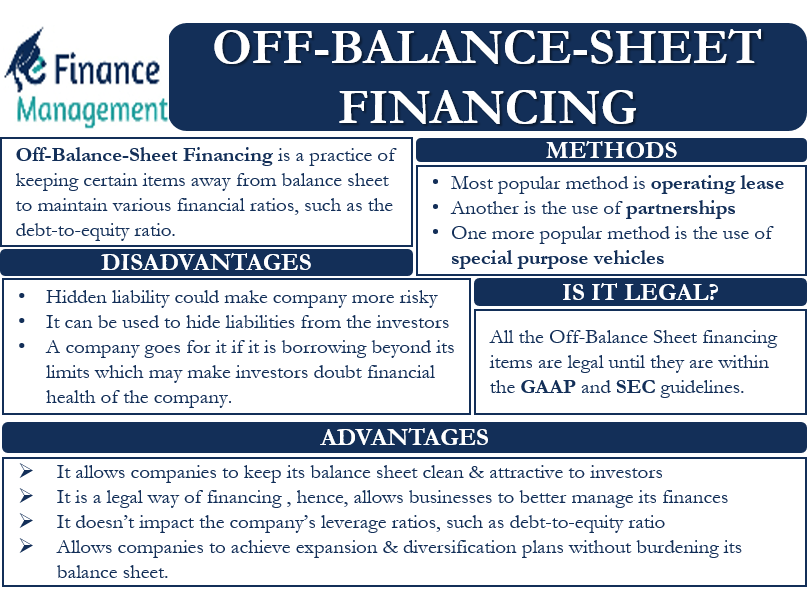

OffBalanceSheet Financing Meaning, Methods, Example & More eFM

These items are assets and liabilities of the company, even if they. They are either a liability or an asset which are not shown on a company’s balance. Obs assets can be used to shelter financial statements from asset ownership and related debt. An obs operating lease is one in which the lessor retains the leased asset on its balance.

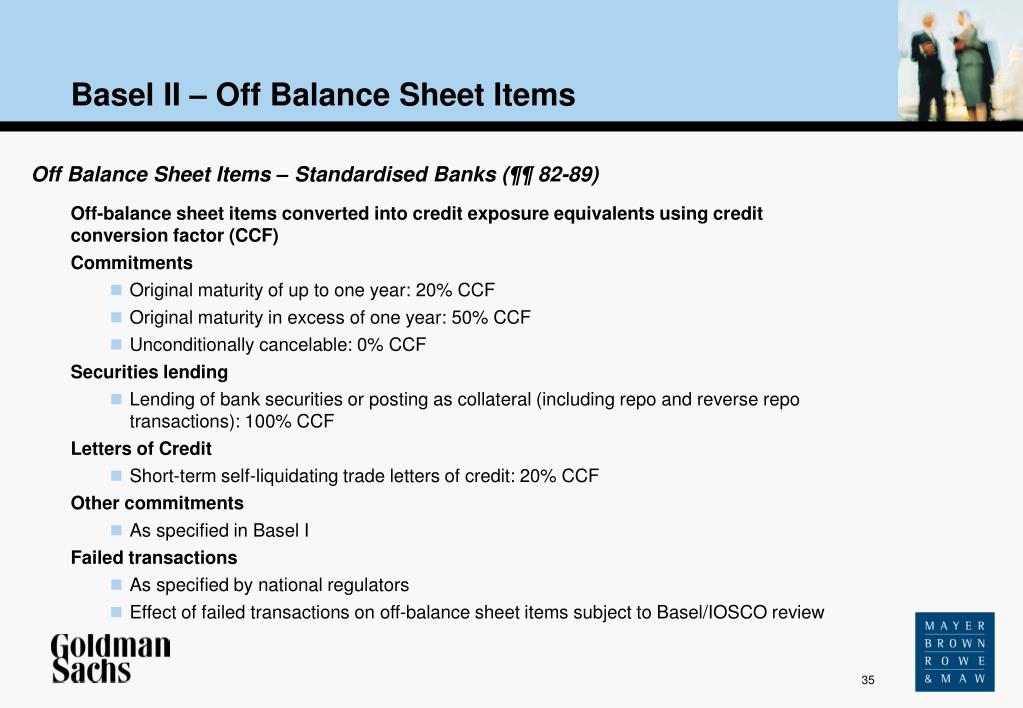

OffBalance Sheet (OBS) Activities Types and Examples Weight

An obs operating lease is one in which the lessor retains the leased asset on its balance sheet. Obs assets can be used to shelter financial statements from asset ownership and related debt. These items are assets and liabilities of the company, even if they. They are either a liability or an asset which are not shown on a company’s.

Off Balance Sheet Financing Is OffBalance Sheet Financing Legal?

An obs operating lease is one in which the lessor retains the leased asset on its balance sheet. They are either a liability or an asset which are not shown on a company’s balance. Obs assets can be used to shelter financial statements from asset ownership and related debt. These items are assets and liabilities of the company, even if.

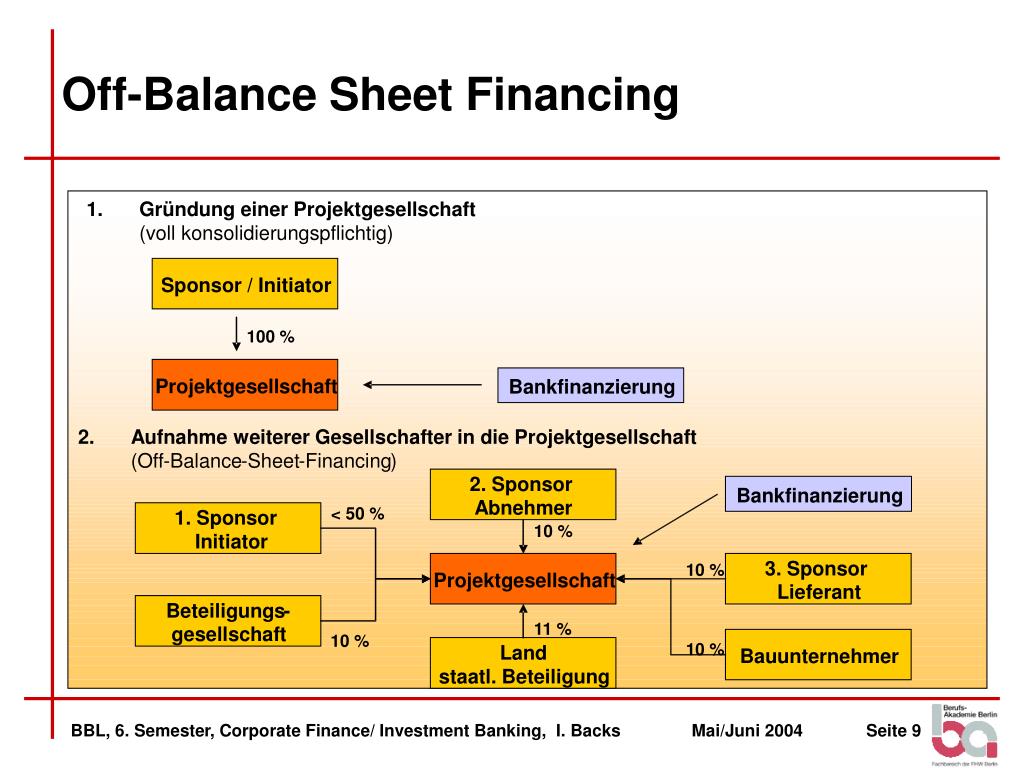

Off Balance Sheet Financing malakowe

An obs operating lease is one in which the lessor retains the leased asset on its balance sheet. They are either a liability or an asset which are not shown on a company’s balance. These items are assets and liabilities of the company, even if they. Obs assets can be used to shelter financial statements from asset ownership and related.

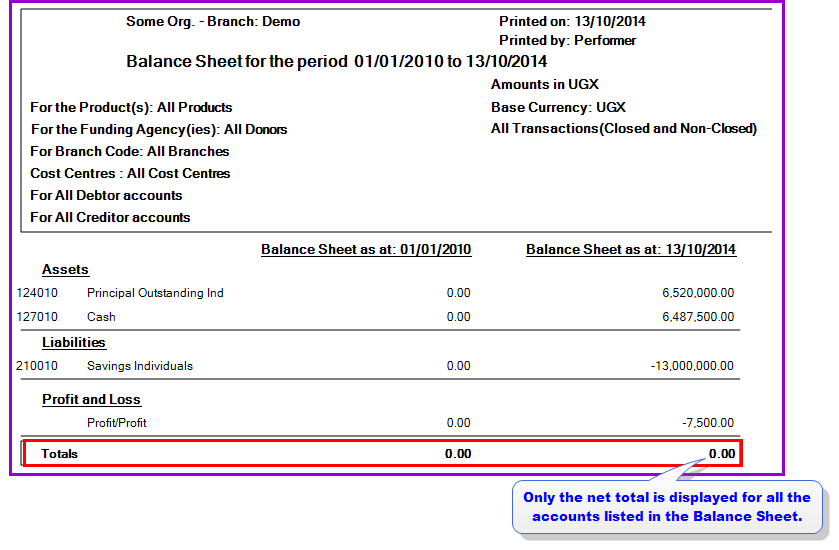

What is off Balance Sheet Accounting Education

An obs operating lease is one in which the lessor retains the leased asset on its balance sheet. They are either a liability or an asset which are not shown on a company’s balance. These items are assets and liabilities of the company, even if they. Obs assets can be used to shelter financial statements from asset ownership and related.

Balance Sheet Example India Dictionary

Obs assets can be used to shelter financial statements from asset ownership and related debt. An obs operating lease is one in which the lessor retains the leased asset on its balance sheet. They are either a liability or an asset which are not shown on a company’s balance. These items are assets and liabilities of the company, even if.

Off Balance Sheet Financing OffBalance Sheet Financing (Definition

These items are assets and liabilities of the company, even if they. An obs operating lease is one in which the lessor retains the leased asset on its balance sheet. They are either a liability or an asset which are not shown on a company’s balance. Obs assets can be used to shelter financial statements from asset ownership and related.

What Is OffBalance Sheet Financing? Definition & Example

They are either a liability or an asset which are not shown on a company’s balance. Obs assets can be used to shelter financial statements from asset ownership and related debt. An obs operating lease is one in which the lessor retains the leased asset on its balance sheet. These items are assets and liabilities of the company, even if.

Off Balance Sheet On Balance Sheet vs Off Balance Sheet

Obs assets can be used to shelter financial statements from asset ownership and related debt. These items are assets and liabilities of the company, even if they. They are either a liability or an asset which are not shown on a company’s balance. An obs operating lease is one in which the lessor retains the leased asset on its balance.

Obs Assets Can Be Used To Shelter Financial Statements From Asset Ownership And Related Debt.

They are either a liability or an asset which are not shown on a company’s balance. These items are assets and liabilities of the company, even if they. An obs operating lease is one in which the lessor retains the leased asset on its balance sheet.

:max_bytes(150000):strip_icc()/Off-BalanceSheetOBS_v2-cf2bd1cd968548168bc24501a8c93d3c.jpg)