Undeposited Funds On Balance Sheet

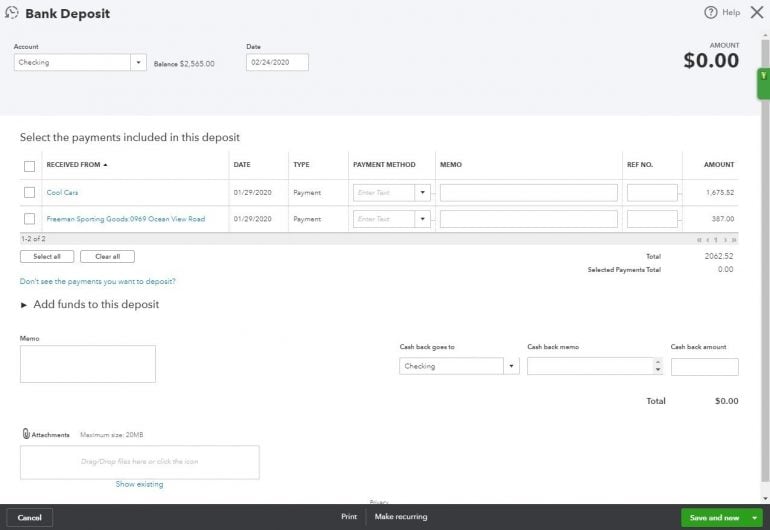

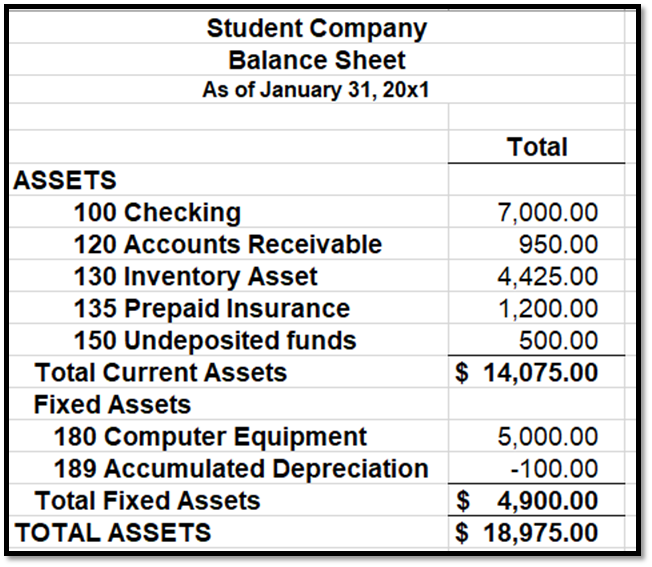

Undeposited Funds On Balance Sheet - First, you can undo your reconciled period, then deposit the amount to the desired bank account. Web the undeposited funds account is meant to be a temporary account. Typically, when you make multiple. Basically, this is money that your company has received from customers but has not yet deposited into your bank account. It’s unique to quickbooks online and its main purpose is to make bank reconciliations easier. Web clean up amount in undeposited funds on balance sheet but not in bank deposits window this will happen when you have a deposit recorded after the date range of the report you are looking at. Web the result was that the undeposited funds made its way onto the balance sheet as a part of their cash assets. Tax time came along, and because of a bookkeeping error, the total revenue of. Web you will find undeposited funds on your balance sheet under other current assets. Web you have two options to resolve the undeposited amount reflected on your balance sheet report.

Web you will find undeposited funds on your balance sheet under other current assets. Tax time came along, and because of a bookkeeping error, the total revenue of. Typically, when you make multiple. Basically, this is money that your company has received from customers but has not yet deposited into your bank account. Web the result was that the undeposited funds made its way onto the balance sheet as a part of their cash assets. Web you have two options to resolve the undeposited amount reflected on your balance sheet report. First, you can undo your reconciled period, then deposit the amount to the desired bank account. Web clean up amount in undeposited funds on balance sheet but not in bank deposits window this will happen when you have a deposit recorded after the date range of the report you are looking at. It’s unique to quickbooks online and its main purpose is to make bank reconciliations easier. Web the undeposited funds account is meant to be a temporary account.

Web you will find undeposited funds on your balance sheet under other current assets. Tax time came along, and because of a bookkeeping error, the total revenue of. Web the result was that the undeposited funds made its way onto the balance sheet as a part of their cash assets. First, you can undo your reconciled period, then deposit the amount to the desired bank account. Typically, when you make multiple. Basically, this is money that your company has received from customers but has not yet deposited into your bank account. Web you have two options to resolve the undeposited amount reflected on your balance sheet report. It’s unique to quickbooks online and its main purpose is to make bank reconciliations easier. Web the undeposited funds account is meant to be a temporary account. Web clean up amount in undeposited funds on balance sheet but not in bank deposits window this will happen when you have a deposit recorded after the date range of the report you are looking at.

QuickBooks® Integration Advanced Topics ShopKeep Support

Web the result was that the undeposited funds made its way onto the balance sheet as a part of their cash assets. It’s unique to quickbooks online and its main purpose is to make bank reconciliations easier. Web you have two options to resolve the undeposited amount reflected on your balance sheet report. Tax time came along, and because of.

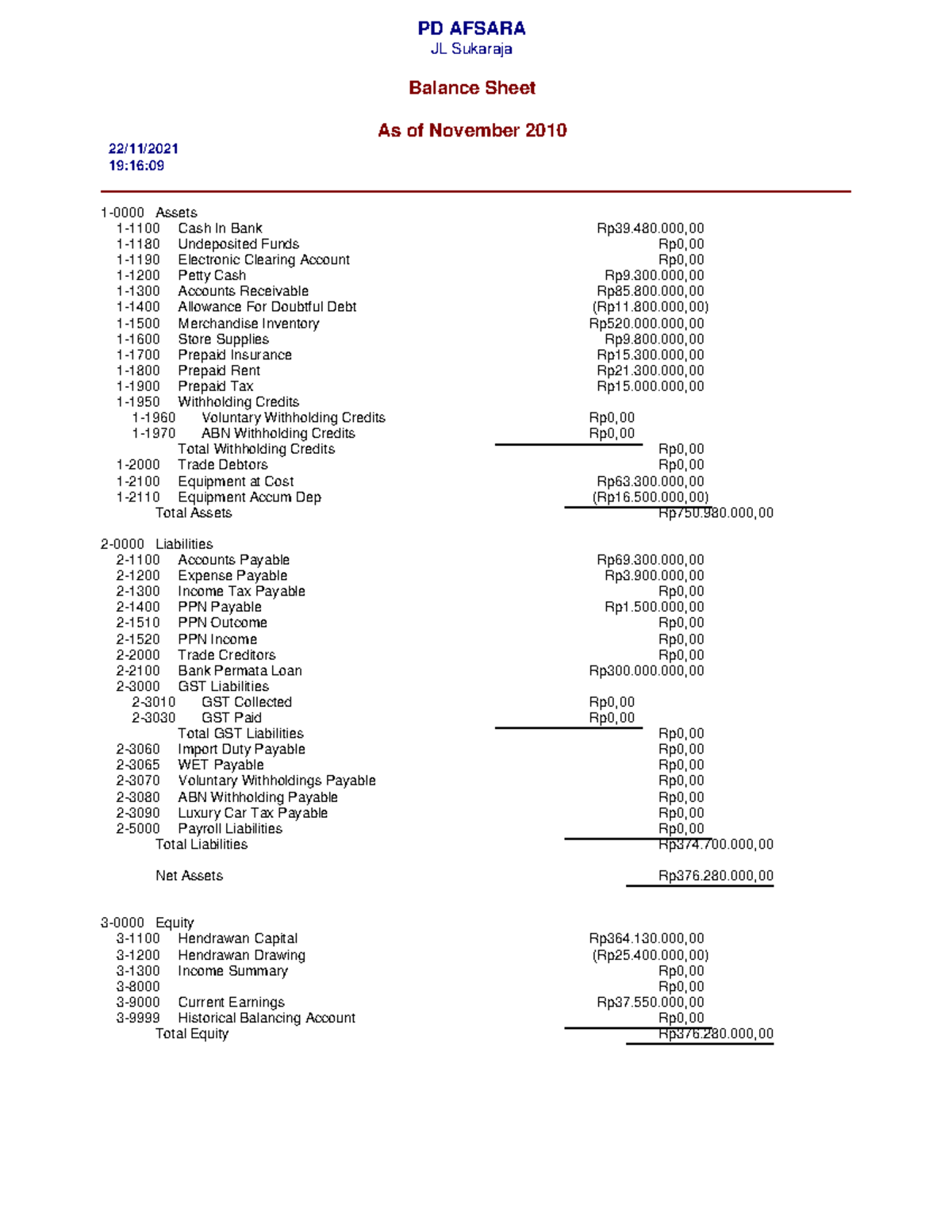

Standard Balance Sheet PD AFSARA JL Sukaraja 11180 Undeposited Funds

Basically, this is money that your company has received from customers but has not yet deposited into your bank account. Typically, when you make multiple. It’s unique to quickbooks online and its main purpose is to make bank reconciliations easier. Web the result was that the undeposited funds made its way onto the balance sheet as a part of their.

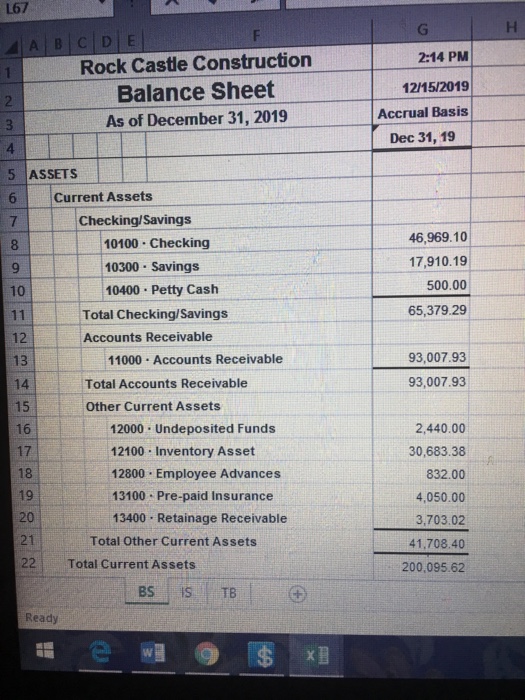

L67 A B C D E Rock Castle Construction Balance She...

Web clean up amount in undeposited funds on balance sheet but not in bank deposits window this will happen when you have a deposit recorded after the date range of the report you are looking at. First, you can undo your reconciled period, then deposit the amount to the desired bank account. Web the result was that the undeposited funds.

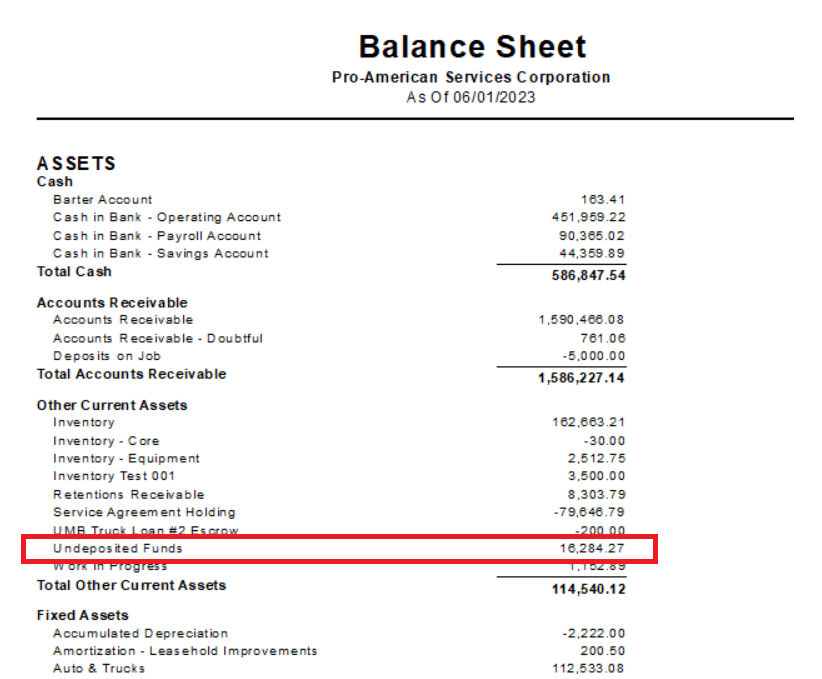

Accounting, Bookkeeping, QuickBooks, Balance Sheet, Accounts Payable

Basically, this is money that your company has received from customers but has not yet deposited into your bank account. It’s unique to quickbooks online and its main purpose is to make bank reconciliations easier. Web you have two options to resolve the undeposited amount reflected on your balance sheet report. Tax time came along, and because of a bookkeeping.

What is Undeposited Funds on the Balance Sheet? AllInOne Field

Tax time came along, and because of a bookkeeping error, the total revenue of. Typically, when you make multiple. First, you can undo your reconciled period, then deposit the amount to the desired bank account. Web you have two options to resolve the undeposited amount reflected on your balance sheet report. Web the result was that the undeposited funds made.

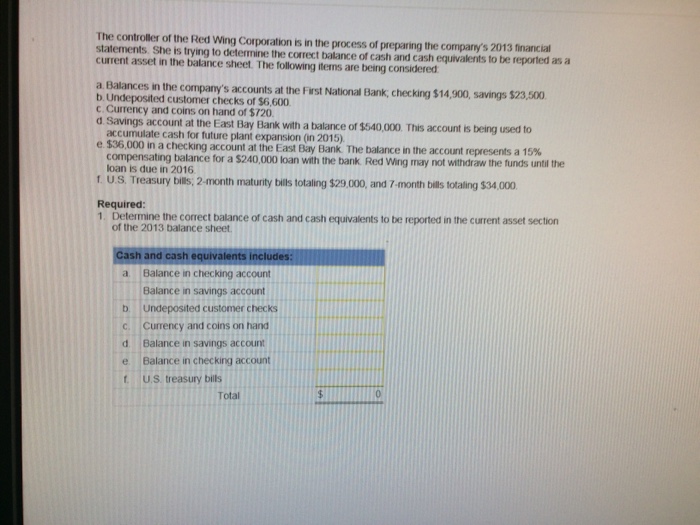

Solved The controller of the Red Wing Corporation is in the

Typically, when you make multiple. It’s unique to quickbooks online and its main purpose is to make bank reconciliations easier. Web you have two options to resolve the undeposited amount reflected on your balance sheet report. Web clean up amount in undeposited funds on balance sheet but not in bank deposits window this will happen when you have a deposit.

Accounting, Bookkeeping, QuickBooks, Balance Sheet, Accounts Payable

Tax time came along, and because of a bookkeeping error, the total revenue of. Web the result was that the undeposited funds made its way onto the balance sheet as a part of their cash assets. Web clean up amount in undeposited funds on balance sheet but not in bank deposits window this will happen when you have a deposit.

How to Use Undeposited Funds in QuickBooks Online NerdWallet

Basically, this is money that your company has received from customers but has not yet deposited into your bank account. Web the result was that the undeposited funds made its way onto the balance sheet as a part of their cash assets. Typically, when you make multiple. Web you have two options to resolve the undeposited amount reflected on your.

Solved You are reviewing the account balances on the balance

Web the result was that the undeposited funds made its way onto the balance sheet as a part of their cash assets. First, you can undo your reconciled period, then deposit the amount to the desired bank account. Tax time came along, and because of a bookkeeping error, the total revenue of. It’s unique to quickbooks online and its main.

One Pager Undeposited Funds Balance Sheet Presentation Report

Typically, when you make multiple. Web clean up amount in undeposited funds on balance sheet but not in bank deposits window this will happen when you have a deposit recorded after the date range of the report you are looking at. Tax time came along, and because of a bookkeeping error, the total revenue of. Web the undeposited funds account.

Web You Will Find Undeposited Funds On Your Balance Sheet Under Other Current Assets.

Web the undeposited funds account is meant to be a temporary account. It’s unique to quickbooks online and its main purpose is to make bank reconciliations easier. Web clean up amount in undeposited funds on balance sheet but not in bank deposits window this will happen when you have a deposit recorded after the date range of the report you are looking at. Web the result was that the undeposited funds made its way onto the balance sheet as a part of their cash assets.

First, You Can Undo Your Reconciled Period, Then Deposit The Amount To The Desired Bank Account.

Basically, this is money that your company has received from customers but has not yet deposited into your bank account. Tax time came along, and because of a bookkeeping error, the total revenue of. Web you have two options to resolve the undeposited amount reflected on your balance sheet report. Typically, when you make multiple.